Why Crypto Faces an Institutional Wall (- Mind Blown!)

Trump-Era Crypto Policies: Hype vs. Reality in 2025

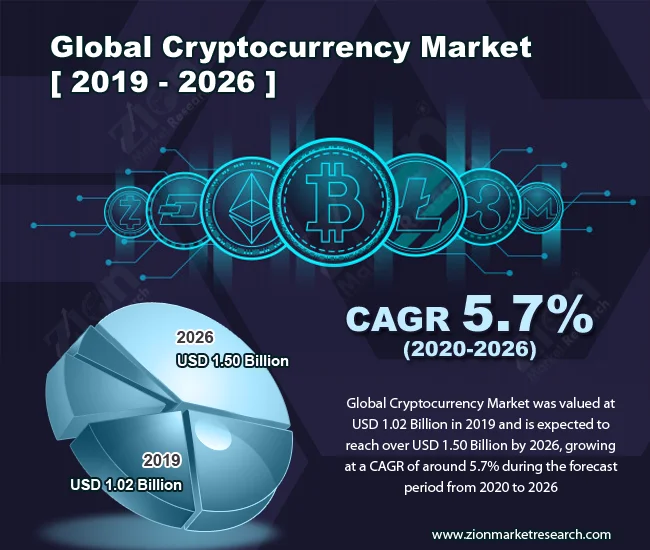

The narrative coming out of the crypto sphere is that 2025 was a banner year, largely thanks to a friendlier regulatory environment under the Trump administration. The Global Crypto Policy Review Outlook 2025/26 Report certainly paints a rosy picture: stablecoins taking center stage, institutional adoption fueled by regulatory clarity, and a global push for consistent regulation. But, as always, the devil's in the details—and the data.

Stablecoins: The Darling of Regulators... and Criminals?

The report highlights that over 70% of the jurisdictions reviewed advanced new stablecoin regulatory frameworks in 2025. This is framed as a positive, driven by the view that stablecoins could become true mediums of exchange. The GENIUS Act in the US, MiCA in the EU, and new regimes in Hong Kong, Japan, Singapore, and the UAE are all cited as evidence.

But let's pump the brakes for a second. While regulatory clarity can foster innovation, it also provides a framework for existing illicit activity to flourish—or, at the very least, a more defined set of rules for those determined to skirt the edges of legality. The report itself mentions North Korea's record-breaking hack on Bybit, which led to the exchange losing over USD 1.5 billion in Ethereum tokens. The attackers laundered proceeds through unlicensed OTC brokers, cross-chain bridges, and decentralized exchanges—infrastructure that, notably, largely sits outside existing regulatory perimeters.

The key question here is: are these new stablecoin regulations actually reducing illicit finance, or are they simply pushing it into less regulated corners of the crypto ecosystem? And, perhaps more importantly, are regulators equipped to keep pace with the evolving tactics of crypto criminals? I haven't seen sufficient numbers on regulatory effectiveness to make a call either way.

Institutional Adoption: Proceed With Caution

The report claims that about 80% of reviewed jurisdictions saw financial institutions announce digital asset initiatives in 2025, fueled by regulatory clarity. Markets with clear, innovation-friendly regulation—such as the US, EU, and parts of Asia—became catalysts for global institutional participation. But let's examine that 80% figure more closely.

What kind of initiatives are these financial institutions announcing? Are they actually deploying significant capital into digital assets, or are they simply dipping their toes in the water with pilot programs and proof-of-concept projects? And, crucially, what's the success rate of these initiatives? Are they generating real revenue and delivering tangible benefits to customers, or are they simply PR exercises designed to appease shareholders and appear forward-thinking?

I suspect the truth lies somewhere in between. Some financial institutions are genuinely committed to exploring the potential of digital assets, while others are simply paying lip service to the trend. The Basel Committee's reassessment of its proposed prudential rules for banks' crypto exposures—rules that would have required full capital deductions for most crypto assets—suggests that even regulators are hesitant to fully embrace the institutional adoption narrative.

And this is the part of the report that I find genuinely puzzling. The report mentions the Basel Committee agreed to fast-track a reassessment of the rules, with signs pointing toward a softening of regulatory attitudes regarding banks’ engagement with digital assets. Seriously? Softening attitudes? What data is that based on?

Global Consistency: A Pipe Dream?

The report correctly points out that consistency is critical to preventing regulatory arbitrage. The Financial Action Task Force (FATF) warned that as long as gaps in standards implementation persist, "VASPs in jurisdictions with weak or non-existent frameworks" remain vulnerable to exploitation. The Financial Stability Board (FSB) cautioned that "gaps and inconsistencies" in implementing standards could pose risks to financial stability and market resilience.

But achieving global consistency in crypto regulation is, at best, a long shot. Different jurisdictions have different priorities, different legal frameworks, and different levels of technical expertise. The EU's MiCA framework, for example, is a laudable attempt to harmonize crypto regulation across the bloc, but even within the EU, national authorities are diverging on their approaches to implementation.

The US, with its patchwork of federal and state regulations, presents an even more complex picture. And in emerging markets, where regulatory capacity is often limited, the challenges are even greater. So, while global consistency is a noble goal, it's unlikely to be achieved anytime soon.

Conclusion: A Cautious "Wait and See" Approach

The Global Crypto Policy Review & Outlook 2025/26 report offers a valuable overview of the evolving crypto regulatory landscape. However, its optimistic tone should be tempered with a healthy dose of skepticism. While regulatory clarity and institutional adoption are undoubtedly positive developments, they also create new challenges and risks. Whether the benefits outweigh the costs remains to be seen.

For my part, I'll wait for clearer data before declaring a victory.

Tomorrow's Ethereum Upgrade: Unlocking a Trillion-Dollar Future (- Get Hyped!)

Next PostThis is the latest post.

Related Articles